Warehouse automation solutions optimize operations and efficiencies by performing redundant and time-consuming tasks that are typically performed by manual workers. Automation removes the overhead for waiting, travel time and motion and allows workers to focus on the tasks that require human intervention. Warehouse automation covers myriad of technology and equipment ranging from storage and retrieval systems, picking systems, sortation systems, conveyors, and palletizing systems to data capture devices, software, and automated guided vehicles. There is also a separate category of automation that includes conveyors that move and direct pick material to the next appropriate operation.

We see substantial growth opportunities in the warehouse automation equipment space owing to several structural trends in consumer demand within eCommerce, retailing and 3PL logistics. According to LogisticsIQ™ latest and exclusive report, Warehouse Automation Market was valued at USD ~15 billion in 2019 and is expected to be worth USD ~41 billion by 2027, at a CAGR of ~15% during the forecast period. Automated Guided Vehicles (AGV) and Autonomous Mobile Robots (AMR) are going to play a pivot role for automated warehouses in next 5 years. Even AGV-AMR Market itself is very attractive market worth ~$18B by 2027 if we do consider all its applications like Logistics, Manufacturing, Healthcare, Shipping, Disinfection, Retail and Inventory Management, Security and Inspection, Agriculture, Hospital Assistance, Indoor and Outdoor Delivery, Cleaning, Tele-presence and Tele-operation, and Data Platforms & Remote Sensing.

Key Drivers:

- Automation is a must for customer fulfillment: Meeting customer demands within e-commerce requires increased adoption of warehouse automation solutions to keep costs and operational complexity in check. Online retailing is fundamentally a logistics business driven by margin improvement from cost reduction in inventory management, order fulfillment, and delivery capabilities.

- Scalable solutions enable Double-digit growth in e-commerce and online grocery sales is driving players to expand capacity to deliver required volumes. Warehouse automation solutions are built for scale and can deliver higher output and more accurate order fulfillment than a manual setup at lower operating costs and can increase the customer satisfaction as well as improve margins by reducing the delivery time as well as cutting down on the cost of wrong orders.

- Cost efficiency and quality. Automated and robotic solutions are easing the increasing pressure felt by online grocery retailers to get orders out to customers more efficiently while reducing fulfillment costs. Warehouse automation solutions can both increase picking speed and volumes while decreasing picking inaccuracy due to a reduction in the number of human interactions. In addition, robots are independent of labor market conditions and can work 24/7 without requiring any overhead costs such as pensions, health insurance, vacations or breaks. They also do not require training, an extra cost associated with the additional or temporary hires necessary during the peak shopping cycles. There remains the need for CapEx to be incurred at the beginning of operations, and ROI calculations are key criteria for any retailer looking to implement warehouse automation. The ROI keeps improving as the cost of the manual trained labor force is increasing, as well as the cost of a miss pick can tend to shift customer loyalty.

- Home-to-Shop direct connectivity: A gradual transition towards “complete connectivity” drives greater demand for warehouse automation solutions as enhanced inventory management systems and data analytics are required to deliver on customer expectations. As the number of daily online shoppers grows across the world, consumers are migrating towards mobile platforms and have learned to expect increasingly personalized product offerings. The growth in smart home/home automation products, e.g. automatic replenishment of a “Smart Fridge” through an Amazon Echo smart speaker, we believe is causing a fundamental shift in how customers will shop in the future. To make this shift possible, full integration of the retail supply chain is necessary.

- Online Grocery Retail: Online grocery retail is the perfect use-case owing to the high-volume, low-margin nature of the business and the constraints involved in storing and delivering “fresh” products that typically involve temperature controlled supply chains. Building and delivering orders that meet increasing customer demands as well as can compete with the produce available in brick and mortar grocery stores in terms of freshness and prices, puts huge pressure on the already thin margins in the grocery retail business. Warehouse automation is a perfect solution for this model, as the order picking and fulfillment process can be made more cost-efficient enabling the retailer to compete on prices as well as offer same-day delivery. Apart this, Micro Fulfillment centers (MFCs) (opportunity worth ~$30B) are also getting popular in this ecosystem due to instant delivery and dark stores demand.

- Efficiency: The spatial savings from reduced warehouse footprints can be up to 85% and reductions in operational costs of up to 65%. Space savings are achieved primarily through storing SKUs higher and denser, and reductions in operational costs are resulting from decreased demand for manual labor.

- Effectiveness: Warehouse automation solutions result in faster process times and reduced picking errors, and hence improved service levels. The speed at which an order can be accurately picked and shipped increases the reliability of the customer’s delivery service and makes operations more flexible in terms of handling late changes.

- Optimization of operations: Warehouse automation solutions can be optimized through programming for continuous improvement in processes such as dynamic storage, inventory management and overnight relocation of goods. Warehouse Management Software provides cataloging of inventory and improves end-consumers’ experience from connectivity and real-time data.

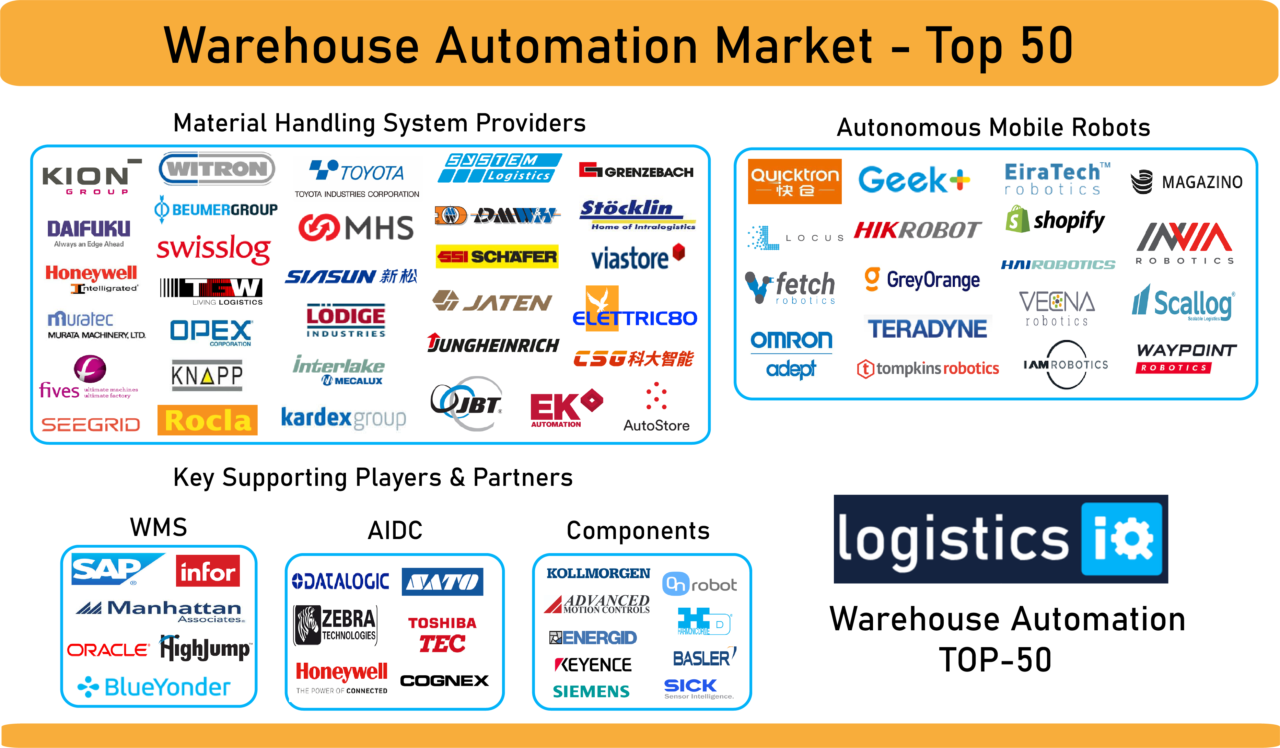

To get the top 50 companies within Warehouse Automation space, we have categorized the entire eco-system into 4 main categories as following

- Material Handling Equipment Providers or System Integrators

- Autonomous Mobile Robots (AMR)

- Automatic Identification & Data Capture (AIDC)

- Warehouse Management System (WMS)

WAREHOUSE AUTOMATION MARKET TOP-50

LogisticsIQ’s latest post-pandemic market research study “Warehouse Automation Market By Technology (AGV/AMR, ASRS, Conveyors, Sortation, Order Picking, Automatic Identification and Data Capture, Palletizing & Depalletizing, Gantry Robots, Overhead Systems, MRO Services and WMS/WES/WCS), By Industry (E-commerce, General Merchandise, Grocery, Apparel, Food & Beverage, Pharma, 3PL), By Geography – Global Forecast to 2027″, estimates that the Global Warehouse Automation Market will reach the milestone of $41 Billion by 2027, at a CAGR of 15% between 2022 and 2027. Visit our page on Warehouse Automation Market for more details.